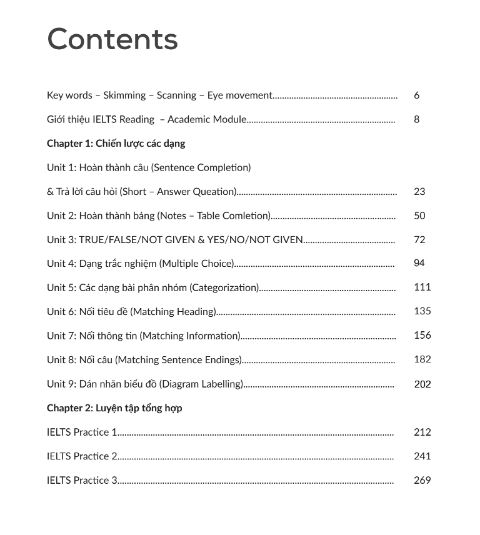

Mục lục

ToggleChapter 1

Chiến lược các dạng

Dạng bài hoàn thành câu là dạng bài phổ biến luôn xuất hiện trong bài thi IELTS Reading.

Đề bài yêu cầu thí sinh tìm từ phù hợp trong bài đọc để điền vào chỗ trống trong các câu được cung cấp.

Unit 1 Hoàn thành câu & Trả lời câu hỏi

1. Chiến lược xử lý dạng câu hỏi

Bước 1: Identifying

• Xác định và phân loại từ khóa.

• Xác định dạng từ cần điền vào chỗ trống và số từ cần điền dựa theo đề bài.

Bước 2: Spotting

• Scan bài đọc để tìm khu vực chứa thông tin cần thiết (dựa trên những từ khoá đã tìm).

• Khi scan đoạn văn, thí sinh lưu ý cần sử dụng kỹ thuật Eye-movement.

Bước 3: Extracting & Answering

• Đối chiếu phần chứa thông tin và câu hỏi. Đọc hiểu phần thông tin vừa tìm được.

• Chọn từ và đối chiếu với dạng từ cần điền đã xác định ở bước 1.

• Đọc lại câu để một lần nữa kiểm tra độ chính xác của thông tin.

Some animals are actually very well-known for their outstanding intelligence compared to most other types of animals in the wild, one of the prime example is chimpanzee. Chimpanzee is a species of ape that is most closely related to humans, which inhabit in tropical forests and savannas. Some basic knowledge about chimpanzees is that their diet is primarily vegetarian, consisting of mostly fruits, leaves, and seeds but also bird eggs and chicks, many insects, which provide them with enough nutrients for the development of mental ability. Chimpanzees are highly intelligent and are able to find solutions for many kinds of problems posed to them by human trainers and experimenters. Since the last few years of the 90s, a number of researchers have successfully taught chimpanzees to use sign languages including those based on the display of tokens or pictorial symbols. Also, communication between chimps in the wild takes the form of facial expressions, gestures, and a large array of vocalizations, including screams, hoots, grunts, and roars. Chimpanzees are also well-known for their skills in using tools. In fact, various tools are used in several contexts. For example, Chimpanzees “fish” for termites and ants with tools made of grass stalks, vines, branches, peeled bark, and midribs of leaves. In other cases, they crack hard nuts open by using stones, roots, and wood as hammers, and they use “leafy sponges” (which are a handful of folded leaves or moss) to drink water.

2. Ví dụ

Questions 1–4

Choose NO MORE THAN TWO WORDS from the passage for each answer:

- Chimpanzee is a species of ape, whose natural habitat includes (a) ………………… and (b) ………………………

- By the end of 20th century, chimpanzees have learnt how to use (c) ………………………… (based on tokens display or pictorial symbols).

- Chimpanzees are famous for their skills in using different kinds of (d) ……………………

- (e) …………………… are used when chimpanzees drink water.

2. Ví dụ

3. Áp dụng phương pháp

Bước 1: Identifying

Xem lại phần lý thuyết về từ khoá trong phần 1 để hiểu cách xác định từ khoá dễ scan.

Câu hỏi:

Chimpanzee is a species of ape, whose natural habitat includes (a) _______ and (b) _______.

Phân loại từ khóa:

- natural habitat → cụm danh từ → dễ thay thế

- Chimpanzee → chủ đề → từ khóa chìm

- include → động từ → chìm

- ape → danh từ chỉ loài → khó thay thế

Dạng từ cần điền:

include → liệt kê → (a) & (b) phải là danh từ / cụm danh từ

Giới hạn: ≤ 2 từ

26

Bước 2: Spotting

Thứ tự ưu tiên: ape → natural habitat → include

Đoạn chứa đáp án:

“… which inhabit in tropical forests and savannas.”

Bước 3: Extracting & Answering

Đáp án:

(a) tropical forests

(b) savannas

27

Áp dụng tương tự cho:

- (c) sign languages

- (d) tools

- (e) leafy sponges

4. Ví dụ 2

WHY INVESTORS ARE CAREFUL BUYERS BUT CARELESS SELLERS

Only the very best think as hard about exiting positions as entering them

WHY INVESTORS ARE CAREFUL BUYERS BUT CARELESS SELLERS

Only the very best think as hard about exiting positions as entering them

A

Most investors would agree that picking the right stocks is crucial to their success in the financial markets. But most investors would also agree that determining when to sell a stock is equally important. In fact, research has shown that investors tend to be far more careful buyers than they are sellers. While they often spend considerable time and effort analyzing potential stock purchases, they frequently lack a systematic approach when it comes to selling. As a result, investors may end up holding on to stocks for too long or selling them at the wrong time, both of which can significantly undermine their overall investment performance.

B

One explanation for this behaviour is that buying tends to be associated with optimism and opportunity, whereas selling is often linked to loss and regret. When investors buy a stock, they do so with the expectation that it will increase in value. Selling, on the other hand, forces them to confront the possibility that their original investment decision may have been flawed. This emotional discomfort can discourage them from selling—even when doing so would be the rational choice. In behavioural finance, this tendency is closely related to the “disposition effect”, a well-documented psychological bias in which investors are more likely to sell assets that have increased in value while holding on to those that have decreased, even when the opposite action would yield better results.

C

A second factor behind poor selling decisions is that investors tend to rely on simple rules of thumb rather than rigorous analysis. For example, many investors decide to sell a stock simply because it has reached a certain price target or because they need money for another investment. Others sell merely because they have held a stock for a long time and feel it is “time to take profits”. These heuristics may occasionally lead to good outcomes, but they often cause investors to sell too early—or too late—without considering the broader context, such as changes in a company’s fundamentals, shifts in market conditions, or alternative uses for their capital.

D

Compounding the problem is that selling decisions are often made under time pressure. When investors notice that a stock’s price is falling, they may feel compelled to make quick decisions in order to avoid further losses. Unfortunately, rushing to sell can make investors more susceptible to emotional reactions and less likely to examine the data objectively. Moreover, investors often receive conflicting advice from financial news, analysts, and friends, which can further complicate their decision-making. The result is that many investors end up selling reactively—responding to short-term price movements rather than following a clear, long-term strategy.

E

Professional investors are not immune to these problems. Although they typically have access to more information and sophisticated analytical tools, they too face emotional pressures, performance targets, and client expectations. Research indicates that even institutional investors—such as mutual fund managers—exhibit systematic biases in their selling decisions. For instance, they tend to sell stocks that have recently performed well, perhaps in an effort to lock in gains and demonstrate skill to clients. At the same time, they often hesitate to sell underperforming stocks, hoping that these will eventually rebound. Such behaviour, while understandable, can result in portfolios that are poorly aligned with long-term investment objectives.

F

A promising solution to the problem of poor selling decisions is automation. Some investors use automated trading systems or predefined rules to determine when to sell a stock. For example, they might set up stop-loss orders that trigger an automatic sale when a stock’s price falls below a certain threshold, thus preventing large losses. Others may use algorithmic strategies that take into account various factors—such as price trends, volatility, or market indicators—before deciding whether to sell. Automation can help remove emotional biases and ensure that selling decisions are consistent, objective, and aligned with an investor’s overall strategy.

G

However, automation is not a perfect answer. Algorithms and rules-based strategies are only as good as the assumptions built into them, and they may fail to adapt to unexpected market conditions. Moreover, automated strategies can sometimes lead to crowded trades, in which many investors sell at the same time, amplifying market volatility. For automation to be effective, investors must continually review and update their models to reflect new information, changing market dynamics, and evolving investment goals. Without such oversight, reliance on automation can create a false sense of security and lead to poor outcomes.

H

Ultimately, the key to better selling decisions lies in adopting a more disciplined, evidence-based approach. Investors should evaluate their reasons for selling with the same level of care and analysis that they apply when buying. This includes assessing a stock’s long-term prospects, considering alternative investment opportunities, and examining how the sale fits within their overall portfolio strategy. By developing a structured process for selling—one that minimizes emotional biases, avoids reliance on simplistic rules, and incorporates both qualitative and quantitative factors—investors can significantly improve their performance and achieve more consistent, rational outcomes in the financial markets.